Let’s be honest—climate change isn’t just melting glaciers or shifting weather patterns. It’s hitting closer to home, literally. Property insurance rates are climbing faster than floodwaters in a hurricane, and coverage options? Well, they’re getting trickier to navigate. Here’s the deal: if you own a home or business, this affects you. Let’s dive in.

Why Climate Change Is Shaking Up the Insurance Industry

Insurance companies aren’t in the business of losing money. When wildfires torch entire neighborhoods or hurricanes leave cities underwater, insurers pay—a lot. In fact, global insured losses from natural disasters hit $120 billion in 2022, and climate change is the elephant in the room.

Think of it like this: insurers use historical data to predict risk. But with climate chaos rewriting the rules, those old models? They’re about as reliable as a paper umbrella in a thunderstorm.

How Climate Change Is Driving Up Insurance Rates

1. More Frequent (and Costly) Disasters

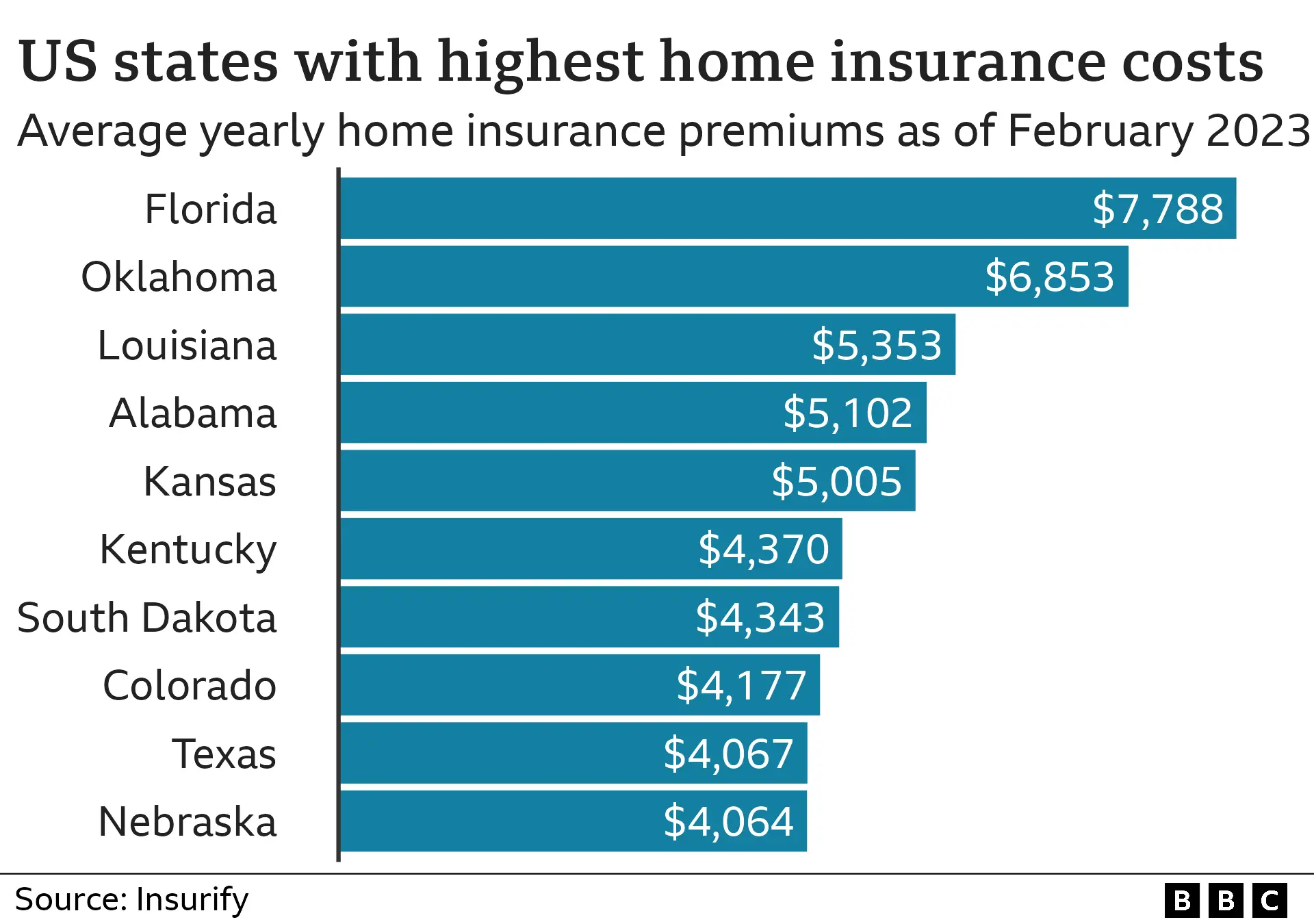

Wildfires, floods, hurricanes—you name it, they’re happening more often. And when insurers shell out billions every year, guess who foots the bill? Policyholders. In high-risk areas, premiums have spiked by 30-50% in just five years.

2. Rising Reinsurance Costs

Here’s something most people don’t realize: insurers buy their own insurance (called reinsurance). As disasters pile up, reinsurers hike prices—and those costs trickle down to your policy.

3. “Uninsurable” Zones Expanding

Florida’s coastline. California’s wildfire zones. Insurers aren’t just raising rates—they’re outright pulling out of high-risk areas. If you’re in one, finding affordable coverage feels like winning the lottery.

How Coverage Is Changing (And What to Watch For)

It’s not just about higher prices. Policies themselves are getting stricter. Here’s what’s shifting:

- Higher deductibles: You’ll pay more out-of-pocket before coverage kicks in.

- Exclusions: Some policies now omit flood or wind damage entirely.

- New requirements: Upgrades like fire-resistant roofs may be mandatory.

What Homeowners and Businesses Can Do

Feeling stuck? Don’t panic. Here are actionable steps to protect yourself:

- Shop around. Insurers weigh risk differently—comparison shopping is key.

- Mitigate risks. Install storm shutters, clear brush, or elevate utilities.

- Consider government programs. FEMA’s NFIP (National Flood Insurance Program) helps in flood zones.

- Review annually. Policies change. So should your strategy.

The Bigger Picture: Is the System Sustainable?

Honestly? The insurance industry’s at a crossroads. If premiums keep rising while coverage shrinks, middle-class homeowners could be priced out entirely. Some experts argue for public-private partnerships—like how some states handle earthquake insurance. Others say it’s time to rethink where (and how) we build homes in the first place.

One thing’s clear: climate change isn’t just an environmental issue. It’s a financial one, creeping into our mortgages, savings, and sense of security. The question isn’t if it’ll affect you—it’s how prepared you’ll be when it does.